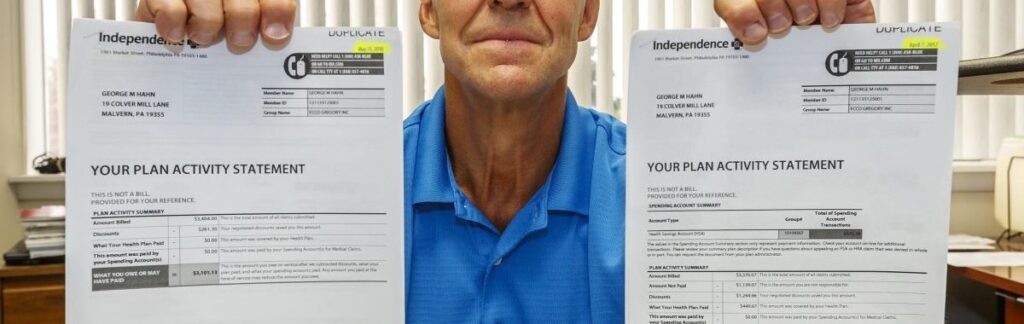

Disabled Military Veteran’s Family Member may be getting Ripped Off by Abrazo West Campus Billing Department – Goodyear, Arizona

A U.S. Military Veteran’s spouse was admitted to the emergency room of Abrazo West Campus. Although it was explained that the current insurance on file (Tricare West) is normally the primary insurance, in this particular instant it was not.

An Abrazo West Campus representative did not want to wait for the issues to be resolved beefier emergency treatment could continue. So Tricare West was incorrectly used as billing.

Billing department of Abrazo West Campus was notified on multiple occasions and provided with the correct issue provider (TriWest Healthcare Alliance) as Follows:

March 20, 2023 – 2pm, talked with a person named Arnell who papered to be correcting the insurance information, and stated it may take up to 45 days to process. However, inside the 45 days, Abrazo West Campus billed Tricare West instead of billing the rested biller TriWest Healthcare Alliance.

Called an Abrazo West Campus representative who identified herself as Rain March 21, 2023 around 10:30am. Explained the issue again and again was assured it would be corrected within or about 45 days.

Another bill from Billing department of Abrazo West Campus arrived once again. Called a third time to Billing department of Abrazo West Campus representative who identified as Margaria on March 31, 2023 at around 2:30pm; once again explaining the issue with assurances’ from the Billing department of Abrazo West Campus representative it would be taken care of.

Another bill from Abrazo arrived, and once again Billing department of Abrazo West Campus was notified of the issue via a Abrazo representative identified as Alexandro on April 10, 2023. After requesting what has happen to the rest of the request to update the insurance information, Alexandro explained that the last person that I talked with entered the wrong code; and assured us that this time it was correct.

It appears that the billing department of Abrazo West Campus has been, and continues to display a level of either incompetence (opinionated) or is just refusing to return the funds that they already collected from Tricare West and a one-time credit card payment by the patient which may be considered fraud by Tricare West.

Veterans and Spouse may be reaching out to the media 3TV in Arizona to help resolved this issue and possibly fraud.

NOTE: Although this issue is not about being able or willing to pay medical related bills as a simple fix would be for Abarzo to honor the patent request (more than three request) to correct bill the correct issuer TriWest Healthcare Alliance instead of using Tricare West; there is a law concerning the reporting of such disputes to a credit bureau reporting agency; The Consumer Protection for Medical Debt Collections Act outlines protections for consumers as follows:

Introduced in House (04/14/2021)

| 117th CONGRESS 1st Session |

H. R. 2537

To amend the Fair Debt Collection Practices Act to provide a timetable for the collection of medical debt by debt collectors, to amend the Fair Credit Reporting Act to prohibit consumer reporting agencies from issuing consumer reports containing information about debts related to medically necessary procedures, and for other purposes.

IN THE HOUSE OF REPRESENTATIVES

April 14, 2021

Ms. Tlaib introduced the following bill; which was referred to the Committee on Financial Services

A BILL

To amend the Fair Debt Collection Practices Act to provide a timetable for the collection of medical debt by debt collectors, to amend the Fair Credit Reporting Act to prohibit consumer reporting agencies from issuing consumer reports containing information about debts related to medically necessary procedures, and for other purposes.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,

This Act may be cited as the “Consumer Protection for Medical Debt Collections Act”.

SEC. 2. AMENDMENTS TO THE FAIR DEBT COLLECTION PRACTICES ACT.

(a) Definition.—Section 803 of the Fair Debt Collection Practices Act (15 U.S.C. 1692a) is amended by adding at the end the following:

“(9) The term ‘medical debt’ means a debt arising from the receipt of medical services, products, or devices.”.

(b) Unfair Practices.—Section 808 of the Fair Debt Collection Practices Act (15 U.S.C. 1692f) is amended by adding at the end the following:

“(9) Engaging in activities to collect or attempting to collect a medical debt owed or due or asserted to be owed or due by a consumer, before the end of the 2-year period beginning on the date that the first payment with respect to such medical debt is due.”.

SEC. 3. PROHIBITION ON CONSUMER REPORTING AGENCIES REPORTING CERTAIN MEDICAL DEBT.

(a) Definition.—Section 603 of the Fair Credit Reporting Act (15 U.S.C. 1681a) is amended by adding at the end the following:

“(bb) Medical Debt.—The term ‘medical debt’ means a debt arising from the receipt of medical services, products, or devices.

“(cc) Medically Necessary Procedure.—The term ‘medically necessary procedure’ means—

“(1) health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine; and

“(2) health care to prevent illness or detect illness at an early stage, when treatment is likely to work best (including preventive services such as pap tests, flu shots, and screening mammograms).”.

(b) In General.—Section 605(a) of the Fair Credit Reporting Act (15 U.S.C. 1681c(a)) is amended by adding at the end the following new paragraphs:

“(9) Any information related to a debt arising from a medically necessary procedure.

“(10) Any information related to a medical debt, if the date on which such debt was placed for collection, charged to profit or loss, or subjected to any similar action antedates the report by less than 365 calendar days.”.

SEC. 4. REQUIREMENTS FOR FURNISHERS OF MEDICAL DEBT INFORMATION.

(a) Additional Notice Requirements For Medical Debt.—Section 623 of the Fair Credit Reporting Act (15 U.S.C. 1681s–2) is amended by adding at the end the following:

“(f) Additional Notice Requirements For Medical Debt.—Before furnishing information regarding a medical debt of a consumer to a consumer reporting agency, the person furnishing the information shall send a statement to the consumer that includes the following:

“(1) A notification that the medical debt—

“(A) may not be included on a consumer report made by a consumer reporting agency until the later of the date that is 365 days after—

“(i) the date on which the person sends the statement;

“(ii) with respect to the medical debt of a borrower demonstrating hardship, a date determined by the Director of the Bureau; or

“(iii) the date described under section 605(a)(10); and

“(B) may not ever be included on a consumer report made by a consumer reporting agency, if the medical debt arises from a medically necessary procedure.

“(2) A notification that, if the debt is settled or paid by the consumer or an insurance company before the end of the period described under paragraph (1)(A), the debt may not be reported to a consumer reporting agency.

“(3) A notification that the consumer may—

“(A) communicate with an insurance company to determine coverage for the debt; or

“(B) apply for financial assistance.”.

(b) Furnishing Of Medical Debt Information.—Section 623 of the Fair Credit Reporting Act (15 U.S.C. 1681s–2), as amended by subsection (a), is further amended by adding at the end the following:

“(g) Furnishing Of Medical Debt Information.—

“(1) PROHIBITION ON REPORTING DEBT RELATED TO MEDICALLY NECESSARY PROCEDURES.—No person shall furnish any information to a consumer reporting agency regarding a debt arising from a medically necessary procedure.

“(2) TREATMENT OF OTHER MEDICAL DEBT INFORMATION.—With respect to a medical debt not described under paragraph (1), no person shall furnish any information to a consumer reporting agency regarding such debt before the end of the 365-day period beginning on the later of—

“(A) the date on which the person sends the statement described under subsection (f) to the consumer;

“(B) with respect to the medical debt of a borrower demonstrating hardship, a date determined by the Director of the Bureau; or

“(C) the date described in section 605(a)(10).

“(3) TREATMENT OF SETTLED OR PAID MEDICAL DEBT.—With respect to a medical debt not described under paragraph (1), no person shall furnish any information to a consumer reporting agency regarding such debt if the debt is settled or paid by the consumer or an insurance company before the end of the 365-day period described under paragraph (2).

“(4) BORROWER DEMONSTRATING HARDSHIP DEFINED.—In this subsection, and with respect to a medical debt, the term ‘borrower demonstrating hardship’ means a borrower or a class of borrowers who, as determined by the Director of the Bureau, is facing or has experienced unusual extenuating life circumstances or events that result in severe financial or personal barriers such that the borrower or class of borrowers does not have the capacity to repay the medical debt.”.

This Act and the amendments made by this Act shall take effect on the date that is 180 days after the date of enactment of this Act.

Reference:

https://www.congress.gov/117/bills/hr2537/BILLS-117hr2537ih.pdf